Today Tesla released their 2019 Q4 Earnings and allowed us to take a look at the fruits of Tesla’s labor over the best year which has become their best thus far.

Tesla’s shareholder letter stated that “2019 was a turning point for Tesla” and I cannot say that they are wrong. Here are some of the financial highlights:

- Total Revenue: $7.384 billion

- Net Income (GAAP): $105 million

- EPS (GAAP): $0.58

- $930M increase in cash and cash equivalents to $6.3B,

In regards to production numbers:

- Model S/X Q4 (2019 Total): 17,933 (62,931)

- Model 3 Q4 (2019 Total): 86,958 (302,301)

- Q4 Total (2019 Total): 104,891 (365,232)

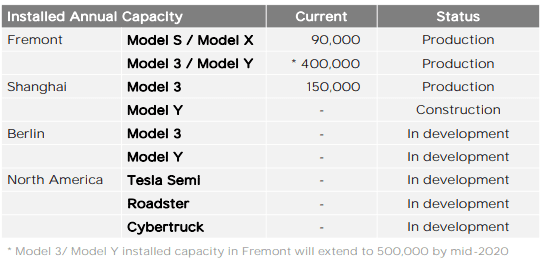

Moving forward to Tesla’s growing number of factories, here is the updated chart on their plans for each factory.

Interestingly Tesla continues to ramp up their expectations for how many cars they will produce. Tesla announced that the Model Y production started this month, ahead of schedule. In Freemont Tesla is planning to be able to build 400,000 Model 3/Y annually with the output increasing to 500,000 by mid-2020. In addition to this half a million Model 3/Y, Tesla has a production capacity of 90,000 Model S/X along with the Chinese-made Model 3s eyeing a 150,000 production capacity for the Shanghai factory.

Interestingly enough, while the Shanghai factory has finished its first phase of construction, the second phase has only just begun and Tesla does not see Model Y production starting until the beginning of 2021. Of course, Tesla has been pushing up their deadlines for both the Model Y and Shanghai factory, so it will not be surprising if the Chinese Model Ys come out of the factory much sooner than anticipated.

The Berlin factory has already started preparations and its first deliveries will be expected in 2021.

Tesla has not made any major announcements for their Autopilot and Full Self Driving features. At this point, Tesla has just been trying to continue refining its software and working on having it be able to identify as many different objects as possible, this includes traffic lights and stop signs.

No major battery announcements were made aside from Tesla announcing that the Model Y AWD has had its range increased from 280 miles to 315 miles. While Tesla states that they have been working hard on improving their battery technology, any new information will not be discussed until Battery Day sometime in April.

Tesla Forward-Looking Statements

- Volume: For full year 2020, vehicle deliveries should comfortably exceed 500,000 units. Due to ramp of Model 3 in Shanghai and Model Y in Fremont, production will likely outpace deliveries this year. Both solar and storage deployments should grow at least 50% in 2020.

- Cash Flow: We expect positive quarterly free cash flow going forward, with possible temporary exceptions, particularly around the launch and ramp of new products. We continue to believe our business has grown to the point of being self-funding

- Profitability: We expect positive GAAP net income going forward, with possible temporary exceptions, particularly around the launch and ramp of new products. Continuous volume growth, capacity expansion, and cash generation remain the main focus

- Product: Production ramp of Model Y in Fremont has begun, ahead of schedule. Model 3 production in Shanghai is continuing to ramp while Model Y production in Shanghai will begin in 2021. We are planning to produce limited volumes of Tesla Semi this year.

The big goal now moving forward is the 500,000 deliveries that Tesla is looking to shoot towards in 2020. In the letter Tesla stated that almost all of their Model 3 orders this year were from new customers rather than previous reservation holders, indicating that there has been a healthy interest in the cars. We have to see if there the hunger for new Teslas continues in 2020.

It however is not all butterflies and rainbows. While it’s great that Tesla has hit all-time highs in regards to their deliveries and free cash flows Tesla has only seen a 2% increase in their revenues over the last year even though they have seen a substantial 42% increase in Model 3 sales (with a 29% decrease in Model S/X). Additionally, Tesla’s gross margin fell 4% over the past year and the company has a net income of -$862 million.

Tesla has a lot of expenses coming up with the continued construction of the Shanghai factory, beginning of the Berlin factory, and the start of both the Model Y and Semi production.

Lets see if 2020 can be an even better year.

What do you guys think of Tesla’s 2019? Let us know down in the comments below.

Source: Tesla