As much as you and Tesla would like it to be, a new Tesla is not an appreciating asset. As with any car, it will sink in value the moment you sign the papers.

Yesterday, during the Lex Fridman Podcast, Elon Musk made what I believe to be one of the most ridiculous statements made by the Tesla CEO thus far. The fact that a Tesla is an appreciating asset is simply… not a fact.

“Buying a car today is an investment into the future. I think the most profound thing is that if you buy a Tesla today, I believe you are buying an appreciating asset – not a depreciating asset.”

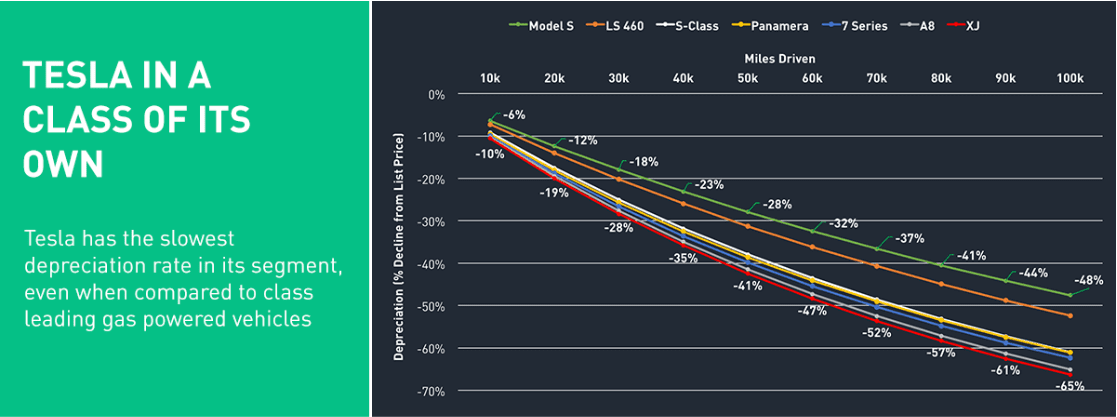

While Teslas do actually retain some of the highest resell value in the industry, there is close to no chance they will move above what you paid — not unless something drastic happens.

Some Tesla Model 3 owners bent this rule and struct gold with their early adoption. They were able to sell their used cars for a profit but that was only due to timing. In the early days, Tesla could not keep up with demand so many were left patiently waiting months for their new electric car. As is with every tech product, the impatient come in willing to pay a premium to get their Tesla Model 3 faster. The same trend exists with Apple’s iPhones and all other tech companies every single year. Once supply catches up to demand, values start to depreciate.

Still, the Model 3 retained some of the best value ever before seen. Even the Model S and X hold the lowest in-class depreciation according to some, but these numbers will continue to decline as your vehicle ages. Your battery will degrade, your maintenance costs will go up, and your resell value will sink. There are just a few ways your vehicle will appreciate and a Tesla Network is not one.

The Tesla Network

The Tesla Network is Tesla’s solution to autonomous ride-sharing. Once their cars are able to achieve full self-driving, Tesla wants to allow owners to turn an income by signing their cars up through the Tesla Network. These cars will leave your driveway and pickup those in need of the service with absolutely no one behind the wheel.

While that sounds awesome and I hope to one day see it happen, this will have no long term affect on resell value. Tesla is not going to stop producing cars. There are around half a million Teslas on the road today that are, what Tesla themselves claim to be, full self-driving capable.

There will be no long term shortage of self-driving Teslas. If Tesla hits their stated goals, in approximately three years there will be more full self driving Teslas on the road than the entire Uber Network has drivers. If Tesla acts quickly, in the beginning there could possibly be a shortage. But with so many cars on the streets, everyone rushing to sell at a premium, the used market will flood.

The only way your car will be worth more than you paid is if Tesla limits this network to early adopters. But why would they do that and limit their own income stream?

A Tesla Bankruptcy

The only other way I see Teslas appreciating is through bankruptcy. A full halt to production would, in theory, raise resell values.

The argument over whether or not your Tesla will become a collectors cars is up for debate. But one thing is for certain, if Tesla goes out of business after achieving full self-driving, your car is just about guaranteed to go up in value. For a short period, there will be no other manufactures with driverless cars.

These Teslas can be used as income sources or even sold to the highest bidder. Without the availability of being able to purchase a brand new Tesla in just a week, your car will appreciate.

But that is it. Without a shortage, you hold no value. Anyone can buy a brand new Tesla at any time and have it delivered in a couple weeks. There will never be a moment your used car is worth more than a new one unless this fact some how ceases to exist.

The Realistic Perspective

Tesla values will move up. It is, in my opinion, the perfect time to buy a used Tesla.

Currently, Teslas are evaluated just like any other car on the road. Sure, they already retain a decent value, but they still are compared within their vehicle class. With Tesla launching full self-driving, they are also launching a new class of vehicles.

We have recently seen used Tesla prices crash and albeit deserved, but with, and when, Tesla is the only company actively producing vehicles that can drive themselves, they will create their own, new, market. Until others step in, full self-driving cars will indeed hold a premium. As Tesla’s technology advances, their resell values will move up. That is until the market is flooded by a heap if companies providing the same technology and service. But nonetheless, values will indeed start to move up along advancements. But they certainly will never reach higher than you paid. Not unless we hit hyperinflation or Tesla doubles the price of their cars.

While your Tesla wont appreciate in value, it will appreciate in emotional value. With each and every over-the-air software update, your Tesla is improving. There are some mornings you will wake up and feel like you are in a brand new car. In the last year we have received a mess of new features such as Navigate on Autopilot, Advanced Summon, and even Atari games. But that personal experience and love for the vehicle wont extend into the resell market.

Update:

Starting May 1

— Elon Musk (@elonmusk) April 13, 2019

Prices of vehicles and their options certainly affect your cars resell value. Increasing the cost for new customers also increases the cost for used customers assuming both vehicles provide the same features. Recently, we saw the used market take a hit after Tesla lowered the price of all of their cars. Since then, they increased them a few times, each affecting resell. Dependent on how high Tesla extends the cost of their Full Self-Driving package, some owners will indeed be holding onto appreciating assets. But this will only affect previous owners who purchased at a lower cost. I am still highly doubtful anyone will be able to get more than they paid for their Tesla in a world where Tesla is still producing cars.

3 comments

“If you buy a Tesla today, I believe you are buying an appreciating asset, not a depreciating asset.” – Musk

Clearly this statement is infradig. But in a very significant sense, for a limited time, it may well be entirely correct.

Tesla production has been battery constrained for over a year. This, despite the short narrative that demand has declined. Demand is solid and needs to be managed. There are levers that can still be pulled to increase demand, not least being advertising. (Personally, on the Southern Tip of Africa, I can’t wait to buy a Tesla, whatever it costs.)

Panasonic have not produced the 34 GWh of batteries they promised at this stage, instead they’re closer to 24 GWh. Tesla have been crippling their Power division for the sake of Model 3 production due to this battery shortage. But Panasonic, after under performing, claiming no profit from the Tesla batteries, are also on shaky ground, particularly as Tesla should close the deal with Maxwell in the next few days. This is technology Tesla will not want to share with Panasonic but will take at least a year or two to commercialise. Panasonic are aware what Musk did to Mobil Eye when they wouldn’t change their kit/software to Tesla’s specs. At the same time, Mobil Eye’s association with Tesla arguably increased their value by billions. Tesla desperately need all the batteries they can get from Panasonic in the immediate term yet Panasonic are not feeling secure in the longer term. So it’s a tense business tango.

If Tesla pull off Full Self Driving before any other company there will be a dire shortage of Tesla cars. Dire! Even at 100% growth per year Tesla won’t be able to satisfy demand for a while, whether it is for their own driving network or for everyone who wants to join their driving network. At 18c per mile costs (Hell, call it 40c) and $1 per mile fees the first to market with FSD will be printing money.

If this happens then anyone who owns a 2017+ Tesla will have an asset that can produce $40k income per year. As Tesla won’t be able to satisfy demand, (and will quite possibly not even sell cars to the public for a while, using them in their own driving pool) anyone with a newish Tesla will be able to re-sell it for more than they paid for it. Never before was a mass produced car an appreciating asset and probably never will be again but for a while Musk’s statement might well be vindicated.

You are wrong, and you should simply say so. Your “update” is nonsense. I literally bought a Tesla on April 30 that I could sell for a $5000 profit today after only the first autopilot price increase. If there was someone who didn’t pay for FSD up front, it’d cost them $8,000 to add it. Or they can buy my car for $3,000 less. AND I got a $3750 tax credit that wouldn’t benefit some buyers (aka they would pay full price for their car from Tesla anyway because they don’t have a $3750 tax liability). That’s a $6,750 margin of appreciation already, and FSD will only get more expensive as it gets better and more widely accepted. It is an appreciating asset, indeed.

Based on Historic precedents you are of course correct , but in the emerging new automotive world order at the macro ,your theories become challengeable. Please try to step out of the current Silo that is Tesla and evaluate the wider EV market and the awful pain challenging the ICE incumbents.

They cannot deliver NEW EVs & do not want to

Generic Ev desire is approaching a tipping point.

Tesla is supply constrained.

New Teslas are too expensive.

Unit Supply of 2nd User Teslas is greater than New non Tesla ( empty promises from Big Auto)

Your fundamental economic Supply & Demand argument has been proven through History, but this is an energy revolution supported by ever growing consumer conscience and Moores Law.

(A Unique synergistic combo)

My 2nd hand 2015 Model S is now worth more than i paid for it in 2017 AND it is more feature rich from OTA upgrades in the context of range,power,speed, ignoring the Huge S/w application enhancements .

New Paradigms are always inconceivable until they cease to be so, usually in recent history.